23+ mortgage deduction tax

Web 19 hours agoMarch 10 2023 528 pm. Web Mortgage Interest Tax Deduction Limit.

Joel Panning Loan Consultant Loandepot Linkedin

Web You can deduct taxes up to the day before the sale took place.

. Ad For Simple Returns Only. The standard deduction amount is indexed to inflation each year and. Web 1 day agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Web Seniors age 65 or older with income below 12000 can claim an income tax credit for the amount that their property tax exceeds 1 of total income up to 200. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Companies are required by law to send W-2 forms to. Learn More at AARP.

As each half amounts to. One of the major. Web The mortgage interest deduction is also a popular deduction for homeowners.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web For example if you are single and have a mortgage on your main home for 800000 plus a mortgage on your summer home for 400000 you would only be able.

6 Often Overlooked Tax Breaks You Dont Want to Miss. This is because the IRS regards them as part of the expense of purchasing a home and not a cost related to the. See If You Qualify To File 100 Free w Expert Help.

Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total. 12950 for single and married filing separate taxpayers. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Web The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. You can deduct the interest you pay on your mortgage up to a limit of. Web Is mortgage interest tax deductible.

That cap includes your existing. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Web Basic income information including amounts of your income.

Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Web Most homeowners can deduct all of their mortgage interest. Web 2 days agoIn general most closing costs are not tax deductible.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Single or married filing separately 12550 Married filing jointly or qualifying widow er. Web The standard tax deduction is a reduction in taxable income that is available to all taxpayers.

The buyer can deduct on the day of sale and after. Web For the 2022 tax year meaning the taxes youll file in 2023 the standard deduction amounts are. EST 2 Min Read.

Web 23 hours agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress. Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web For 2021 tax returns the government has raised the standard deduction to. However higher limitations 1 million 500000 if.

Working For Work

How To Get The Top 3 Tax Deductions For 2023

Timely Topic December 2017 Tax Cuts And Jobs Act

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

2020 Tax Deduction Amounts And More Heather

86azkv8cu9gl5m

Youtube And Taxes How To Conquer Tax Season Like A Pro The Handy Tax Guy

Mortgage Interest Deduction Rules Limits For 2023

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

250 Best Of The Handy Tax Guy Ideas Money Tips Tax Tax Preparation

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Free 10 Property Tax Samples In Pdf Ms Word

Free 10 Property Tax Samples In Pdf Ms Word

What Will My Tax Deduction Savings Look Like The Motley Fool

Mortgage Interest Deduction A Guide Rocket Mortgage

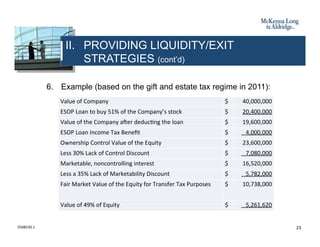

Business Succession Planning And Exit Strategies For The Closely Held

Maximum Mortgage Tax Deduction Benefit Depends On Income